The products and services mentioned in this article may not be available in your region. Please reach out to customer support or your account manager if you have questions.

How to track business expenses: 6 steps to follow

As the old saying goes, it takes money to make money. And while small businesses usually aim to keep their expenses low, few can get off the ground and stay successful without spending money. Since you’re going to have expenses, you’ll need to determine the best way to keep track of them.

What are business expenses?

Let’s start with the basics: business expenses are any kind of spending you do for the sake of your business. The people you hire, the materials you buy, and the brick-and-mortar storefront you rent are all business expenses.

Common types of business expenses

Businesses of different types will face different kinds of expenses, but some of the most common to keep in mind include these:

- Any spending related to your business storefront or offices (such as rent, maintenance, utilities, and yard work)

- The cost of employees and contractors you hire

- Marketing and advertising expenses

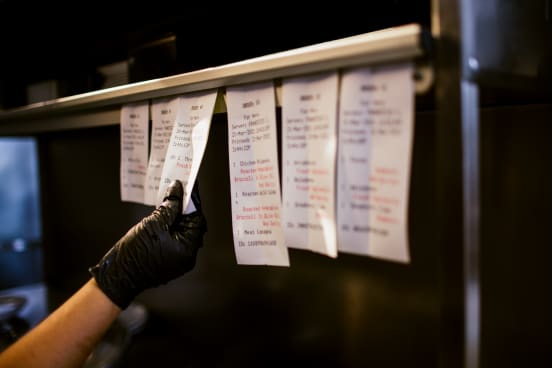

- The materials used to create your products (such as food ingredients and commercial kitchen supplies for a restaurant, or flowers and vases for a florist)

- Office supplies

- Business software

- Business-related travel expenses

- Any professional development or networking costs (such as dues for the local Chamber of Commerce, or courses you take to improve your skills)

For small business owners, the line between personal life and business life can get fuzzy, but recognizing the difference between personal and business expenses is important.

This is especially true for any businesses planning to include business expenses in tax preparations. If you're hoping to save money in taxes by listing your expenses as deductibles, it's crucial to learn the specific laws and classifications around what counts as a business expense in your country.

Why business expense tracking matters

Tracking business expenses isn’t just beneficial; it’s a fundamental part of running a business. It matters for a few main reasons:

You can’t calculate your profits without knowing what you spent. Measuring business success isn’t just about how much you earned; it’s about your overall profit. Half of calculating profit is knowing how much you spent.

Your expenses could affect your business taxes. Many countries allow businesses to deduct business expenses and pay less in taxes as a result. But you have to know what your business expenses are for this to be an option.

Understanding expenses is required for making (and sticking to) a business budget. A budget helps you manage expenses and keep them to a level you can afford. Tracking expenses is an important part of budgeting.

Anytime you need to cut costs, you need to know your expenses. Figuring out which costs you can reduce or cut depends on knowing what you’re spending. And tracking business expenses enables you to catch when something costs more than usual, or more than it’s worth.

If you ever need a loan or investor, they’ll need to see your expenses. If someone from outside needs to weigh whether your business is a safe investment, they’ll need to see your expenses (along with your earnings) to make a decision.

What is the easiest way to track business expenses?

Big businesses can afford to have full-time accountants on staff to take care of this stuff. But how do small businesses keep track of expenses? You’re busy. You may not be trained in bookkeeping. You need to find the easiest option for small business expense tracking.

For most small business owners, that means finding an easy-to-use accounting software that simplifies the process, and developing a system for business expense tracking that helps you keep up with it regularly. No matter what, it requires work. But the right tools and process will make it more manageable.

6 steps for keeping track of expenses

Setting up your business expense tracking process correctly involves half a dozen main steps.

Step 1: Use a devoted business credit card

Small business owners may often start out by putting business expenses on their personal credit card for the sake of convenience. But using a business credit card accomplishes the same thing as opening a business bank account: it helps you keep business expenses separate from personal expenses, making the accounting process easier. Just make sure you only use your business credit card for business purposes. If you unthinkingly use it for personal purchases, that defeats the purpose (and could be against the terms of your cardmember agreement).

Step 2: Keep your receipts

Create a system to make sure you don’t lose your receipts before you record them. If a lot of your purchases create paper receipts, store them where you won’t lose them and consider how to organize them to make your life easier later, such as file folders labeled by date or category.

If you find digital files easier to work with, digitize your receipts regularly. For many types of purchases, you can get digital versions of the receipt automatically (such as with online orders). For others, you’ll need to scan paper receipts. You can use an old-school scanner, if you have one, or a receipt-scanning app designed to make the process easier.

Step 3: Choose the right tool for business expense tracking

In addition to the receipt apps mentioned above, a whole category of software products is devoted to making accounting work easier on small business owners. Figuring out your best option depends on your business needs and personal preferences (and potentially those of your accountant, who can be a good source for helping with this step and the next).

Logging expenses in a spreadsheet may work fine for you, but many accounting software products offer features, such as automation, that simplify business expense tracking. They let you link your bank account so expenses get logged automatically, while also offering other useful accounting features like invoicing and reporting.

Step 4: Develop a process to track business expenses

Defining your process will depend on the tool you choose, but the right tool will only be effective if you develop a good process. Based on the features available, work out a step-by-step process for keeping your expense tracking up to date and well organized.

This is a good step to consult with an accountant on. They can advise on the main categories to include and what kind of expenses go in each. Beyond clarifying your process here, figure out what you need to do to stay on top of it. That could mean making it part of your daily routine or setting up a recurring calendar alert.

Step 5: Create employee guidelines for business expense tracking

If your business has employees, create a process that clearly defines how they should handle expense tracking for any purchases they make for the business. Document step-by-step guidelines that establish what they should do with receipts, who’s responsible for logging the expense, and how they should do it.

Step 6: Stay on top of your small business expense tracking

This is easy to say but probably the hardest part to do. Small businesses stay busy, and there are always other things that need your attention. But the longer you procrastinate, the bigger a job it becomes. You can spend a little time on it each day or week, or end up stuck devoting long, tedious hours to the process when your accountant issues a deadline.

Simple record-keeping tips for small businesses

A smart approach to small business expense tracking can help you keep things relatively simple. Here are a few additional tips on how to keep track of business expenses:

Avoid using cash for business-related expenses

Cash transactions are difficult to keep track of. In comparison, everything you put on a business card will show up neatly on your monthly statement. If there’s a compelling reason to use cash for a business purchase, make a special point to get a receipt, and make sure you don’t lose it.

Let technology help

If you’re a spreadsheet whiz with a system, stick with what works for you. For anyone who really wants to make business expense tracking (and other accounting tasks) easier, technology can simplify things. An upfront cost in a software product or app that offers useful features can save you time and frustration down the line.

But beyond making those investments—use them. Take time to understand the features available and incorporate them into your process. If the software lets you connect your bank account to automate expense tracking, do it. And see if other tech products you use have features that make things easier too. If you use a third-party platform to process orders or payments, check if they offer analytics to simplify keeping track of your expenses with them. No reason to make the work any harder or more tedious than it has to be.

Stick with a system that works for you

The best system for small business expense tracking is whatever one you’ll stick with. If you try out a new process but feel you were better off with the old, familiar one, go back to what worked. If your current process leaves you constantly behind or missing expenses, try something different. There’s not one right way here, just the way that gets things done.

Keep track of your Uber Eats business expenses and revenue

Whether your business is already using Uber Eats or considering it, you may be wondering how to keep track of business expenses within the Uber Eats platform. Uber Eats provides functionality to easily view the business expenses related to Uber Eats orders.

To start, the app provides rich analytics that turn the data Uber Eats has into insights for your business. Using this functionality, you can get a granular breakdown of your sales to see which items are getting the most attention from your customers, track order accuracy by store to see which locations are operating most efficiently, and learn how much particular marketing promotions pay off for your business.

Additionally, the Payments tab in the Uber Eats Manager dashboard allows you to view a breakdown of your expenses for all orders made through the app. Take a look at the video below to see how you can drill into specific expense categories including fees, customer refunds, taxes, and marketing spending:

All of this enables you to make better decisions on where you invest your business funds.

Business expense tracking enables smarter spending

Smart spending is key to good business. Because—as we started out saying—you really do have to spend money to make money. But staying aware of how much you spend, where it goes, and how much it pays off, is one of the things that sets successful small businesses apart.

Uber Technologies, Inc. and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting professionals before making any decision related to the subject matter of this article.

Services

Services

Technology

Manage orders

Simplify operations

Grow your sales

Reach customers

Who we serve

Who we serve

Pricing

Resources

Customer Hub

Learn

Contact us